Blocktime: 908’921 | Moscowtime: 08:62 | Reading time: 2 Blocks

Bitcoin is a tool for financial self-determination. The following stories illustrate how people around the world have used Bitcoin to escape state arbitrariness, repression, war, and control — and how it helped them create new perspectives.

Long before the focus topic of this magazine issue — “Bitcoin is sovereign.” — was finalized, I had been thinking about whether, and in which individual life situations, Bitcoin could serve more than the currently overused narratives of “digital gold,” “strategic Bitcoin reserves,” and “store of value.” This text was first published in issue 4 of #21magazin.

My initial inspiration came from Alex Gladstein (CSO of the Human Rights Foundation), especially Chapter 4 in “The Little Bitcoin Book“, titled “Why Bitcoin is important for the protection of human rights.” I was particularly touched by the story of Afghan technology entrepreneur Roya Mahboob, who paid her female employees in Bitcoin because their male relatives wouldn’t allow them to open a bank account — and would even confiscate their cash salaries. One of these women even had to flee Afghanistan because her life was in danger. Thanks to the Sat saved on her phone, she was able to escape through Iran and Turkey. Fortunately, the value of Bitcoin rose dramatically during her journey, enabling her to start a new, independent life in Germany.

Bank Account Freezes on the Rise.

During the COVID hysteria, it became clear that even in so-called developed, Western democracies, bank accounts of law-abiding citizens could be frozen overnight for not aligning politically or ideologically with the government — or for financially supporting truckers protesting illegal pandemic measures. In supposedly liberal Canada, martial law was quickly declared, protesters were branded terrorists, and donors’ bank accounts were frozen.

Family Support Not Welcome in Switzerland.

The story of Samir A. shows that even in Switzerland, access to one’s own account can be denied without fault. When he was four, his mother fled Gaza with him and his brother to Switzerland. He attended public school and trained successfully as a butcher. As an adult, he started financially supporting relatives who remained in Gaza. But about six months ago, without warning, his salary account was frozen. To this day, Samir is waiting for access to his account and money. A Bitcoin balance would have partially protected him from this expropriation — at the very least, he wouldn’t be relying on government aid today.

How Bitcoin can protect against state and political arbitrariness is demonstrated by the following stories of Win and O. Both fled crisis-ridden countries — either due to political persecution or to escape Putin’s invasion. In both cases, Bitcoin served as an “escape currency” that enabled a sovereign new beginning in their host countries.

Existential Self-Determination Thanks to Bitcoin.

Win was born in 1993 in Yangon, Myanmar’s largest city — a country only beginning to emerge from decades of brutal military rule. In August 1988, five years before his birth, Myanmar saw the largest civil uprising in its history. Hundreds of thousands took to the streets; the military responded with brutal force. The so-called 8888 Uprising was bloodily crushed, thousands lost their lives. These events directly impacted Win’s childhood. The ongoing civil war that began in 1948 shaped society. International ties were weak, education underfunded, media controlled.

Growing Up in Distrust.

Win’s mother left his father when Win was three months old. She ran a small business with three employees — enough to send him to a public school, but not more. Life was marked by economic insecurity. A particularly formative event was the 1987 demonetization: overnight, the government invalidated 80% of the nation’s cash — without compensation. Win’s family was affected. The lesson: money can disappear — just like that.

In the 2000s, the internet reached Myanmar. As a student, Win spent hours in internet cafés — not just gaming, but learning English and acquiring knowledge unavailable through the official education system. Access to international information was banned. VPNs became lifelines — and a risk. Anyone caught with anti-regime content or Western media risked repression.

A Democratic Spark of Hope.

In 2010, Aung San Suu Kyi was released from house arrest. Her party won the 2015 elections. A turning point for Win. He started studying law, but soon switched to tech. It was during this time he encountered cryptocurrencies — initially a novelty, but Bitcoin would soon become existential.

A Digital Influencer with Reach.

Win became well-known on social media — especially Facebook, where he had up to 500,000 followers. In 2020, he published a book on local economic solutions, digital self-employment, and building businesses without traditional infrastructure. It resonated with a generation disillusioned by the system — and became the best-selling book in the country.

On February 1, 2021, the military staged another coup. Aung San Suu Kyi was removed, many politicians arrested. Win knew he couldn’t stay silent. He called for peaceful protest on his platforms. Weeks later, he was labeled a state enemy on national TV and his bank accounts were frozen. Economically cut off, he had no access to cash, no way to escape, no legal defense — in Myanmar, this usually means prison, torture and often death.

Bitcoin as a Lifeline.

Win had started investing in cryptocurrencies back in 2019 — initially for economic reasons, in a country with no reliable banks, no credit, no ownership prospects. But now, faced with mortal danger, he saw Bitcoin’s real strength: decentralization, censorship resistance, independence. While his fiat savings were inaccessible, Bitcoin and Stablecoins funded his escape. He fled to Thailand, lived in exile for four months — and survived.

A New Beginning in the U.S.

In 2022, Win legally moved to the U.S. Thousands of other activists had to abandon resistance — they lacked the financial means. Win not only escaped but now helps others. Through trusted friends on the ground, he supports his mother in Yangon via Bitcoin, converted into local cash.

From Persecuted to Bitcoin Advocate.

Today, Win works for the Human Rights Foundation in the U.S., teaching people in oppressed regions how to use Bitcoin safely as a tool of financial self-determination. His transformation from “crypto generalist” to Bitcoin maximalist was influenced by encounters with activists like Alex Gladstein.

Financial Independence Amidst War.

Even before the war in Ukraine, O. saw financial independence as essential. But it wasn’t until the violence escalated in February 2022 that she realized how vital it was — and how Bitcoin would become key in her life. At university, she studied cryptography and became fascinated with encryption, elliptic curves, and the idea that information is often the most valuable thing. She first heard of Bitcoin in 2016 — it seemed abstract and theoretical, but trusted professors sparked her interest.

She began working in crypto startups in 2017 — first in design, then marketing. The founders had big visions: fight corruption, promote innovation, build a fair financial system. But Bitcoin’s core principles — hard money, decentralization, resistance to state control — were often overlooked. That changed rapidly.

February 2022: War Begins.

Even before Russia invaded, many Ukrainians lived in hardship. The minimum wage was around €180, pensions often just €50/month. Many turned to risky investments — often in crypto. Ukraine already ranked among the world’s top crypto adoption countries.

O. left her home with just a bag, thinking she’d spend a few days in Kyiv. She didn’t bring a passport. After arrival, returning home was impossible — no trains, no transport, chaos at the stations. Explosions rocked the city. An 80-kilometer column of Russian tanks rolled toward Kyiv. On the second day, Kyiv and her family came under siege. Like millions of Ukrainians, O. was in mortal danger — no plan, no destination, no idea if she’d ever return.

Independence in the Camp.

Later, a friend from Germany told her to seek the same refugee center she was staying in. What she found was sobering: 3,500 residents, barely 40 from Ukraine. At the entrance: body checks, fingerprinting, cash and phone registration. The camp was fenced, watched, and resembled a prison. She couldn’t lock her room. Her life was controlled.

Meanwhile, Ukraine’s central bank imposed strict capital controls. Crypto exchange transfers were blocked. People relying on crypto were left stranded — proving the fragility of state-run finance. O. couldn’t lock her door, but she could secure her money in self-custodied Bitcoin. Amid collapsing systems, she retained some sovereignty.

Between Crisis and New Beginning.

Two weeks later, she got an official document — with photo — allowing her to leave the camp. But it wasn’t a passport. Without papers, she couldn’t work, rent a flat, or open a bank account. In Den Haag, she finally got a certificate of Ukrainian citizenship and found housing in the Netherlands. Still no work permit — but she had Bitcoin.

Through BTCmap, she found over 30 places accepting Bitcoin: cafés, hairdressers, stores. She began learning about the Lightning Network. Every expense was carefully considered due to Bitcoin’s volatility. But using her phone like a bank card was a major advantage.

Safe thanks to Bitcoin.

Bitcoin provided O. with something she couldn’t find anywhere else at this stage in her life: security. She didn’t have to worry about theft or confiscation—her assets were digital and self-held. At the same time, she was independent of banks or government agencies that denied her access to financial services. Protection against inflation also became an important factor, as her savings retained their purchasing power better in Bitcoin than in the Ukrainian national currency. In addition, she was able to use Bitcoin to buy food and other everyday necessities via platforms such as “Bitrefill.”

Most importantly, Bitcoin gave her control — emotional stability in a time of total uncertainty. She hadn’t cared about Cypherpunk ideals before. But necessity made her realize the importance of sovereignty and digital self-determination in a crisis-ridden world.

Bitcoin as a Beacon of Hope.

Her family still lives in a war zone. They refuse to flee — despite constant danger. But they now understand Bitcoin’s value. It seemed safer than hiding cash or trusting banks. When Bitcoin reaches new highs, her father messages her: “It was a good day.” He asks questions, fascinated by the tech that once saved his daughter’s life.

After much persuasion, her parents gave their mattress savings to a trusted friend in the city — who converted them into Bitcoin. It wasn’t much, but it was all they had. Today, they know this digital money might one day open the door to a new life.

O. now has a passport again. Her journey continues. She lives out of a backpack — and saves in Bitcoin. Her recent years taught her one truth: real safety doesn’t come from states — it emerges from decentralized networks without borders.

If you want to learn more about “Bitcoin is sovereign,” order issue 4 of EINUNDZWANZIG-Magazine now:

If this post has been helpful to you, I would appreciate a small donation and/or your feedback.

value4value-Donation:

lnurl1dp68gurn8ghj7mrww4excmnhvvhxgetwduhxgetk9akxuatjd3cz7vrzxqenqv34xckn2vfkxckngwrpx5knjvm9xukngetrxd3nvvtpxcengvskmuz4c

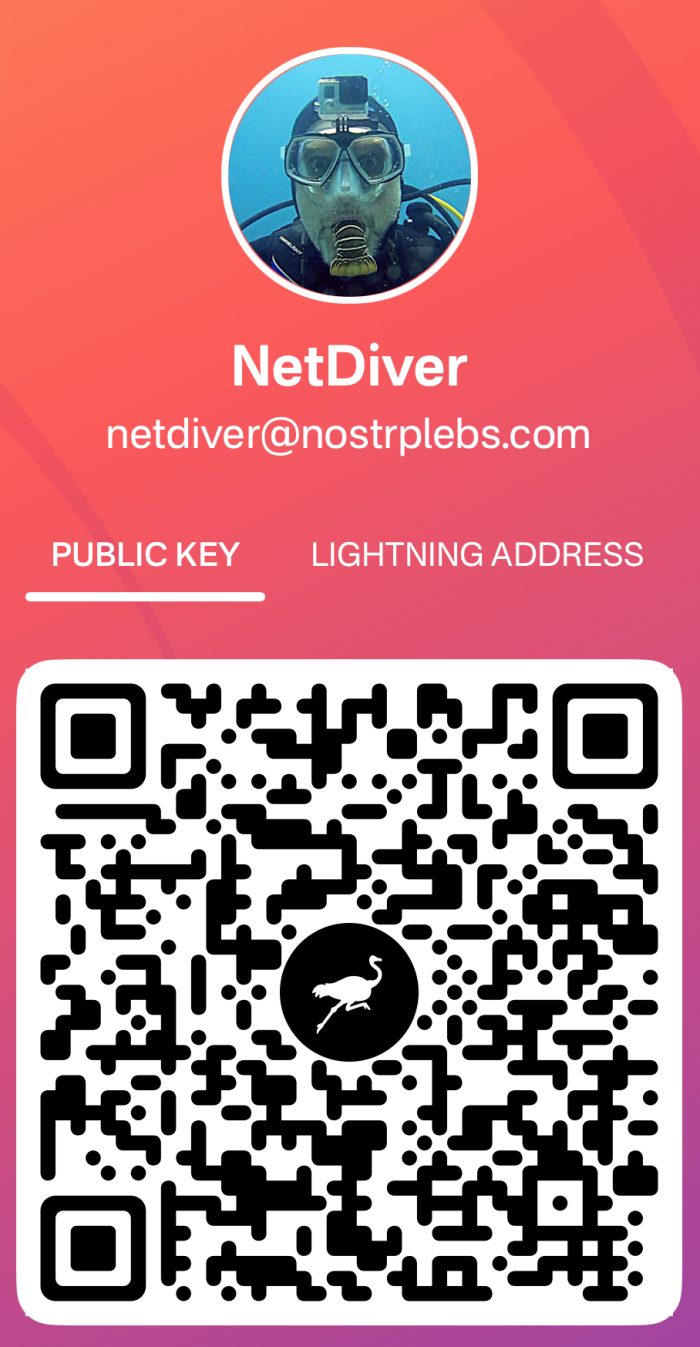

NOSTR:

npub1z77juddgcul5la7jq578nsurpxh99633ccanngf863m4gh6gv2msm009sr